A look at the how the aerospace connectivity market is developing along two, distinct paths

April 30, 2019

Below we take a look a further look at developments in the aerospace connectivity market

Internet from the skies, beamed down from 1000s of satellites and delivering connectivity to any place on Earth. You could be forgiven for only thinking of SpaceX when you picture that scenario but to do so would be to overlook a distinct dichotomy emerging within the market.

Of co urse, market coverage focuses on big names and big people – SpaceX, Virgin, OneWeb with Musk, Branson and a Bezos thrown in for good measure. These individuals and their companies are flag bearers for a development that promises to truly revolutionize connectivity in the next couple of decades. And, for once, the hyperbole is justified: SpaceX’s Starlink has its first satellites in orbit, OneWeb has its first satellites in orbit and Iridium’s NEXT 66 satellite constellation finally became operational last month.

urse, market coverage focuses on big names and big people – SpaceX, Virgin, OneWeb with Musk, Branson and a Bezos thrown in for good measure. These individuals and their companies are flag bearers for a development that promises to truly revolutionize connectivity in the next couple of decades. And, for once, the hyperbole is justified: SpaceX’s Starlink has its first satellites in orbit, OneWeb has its first satellites in orbit and Iridium’s NEXT 66 satellite constellation finally became operational last month.

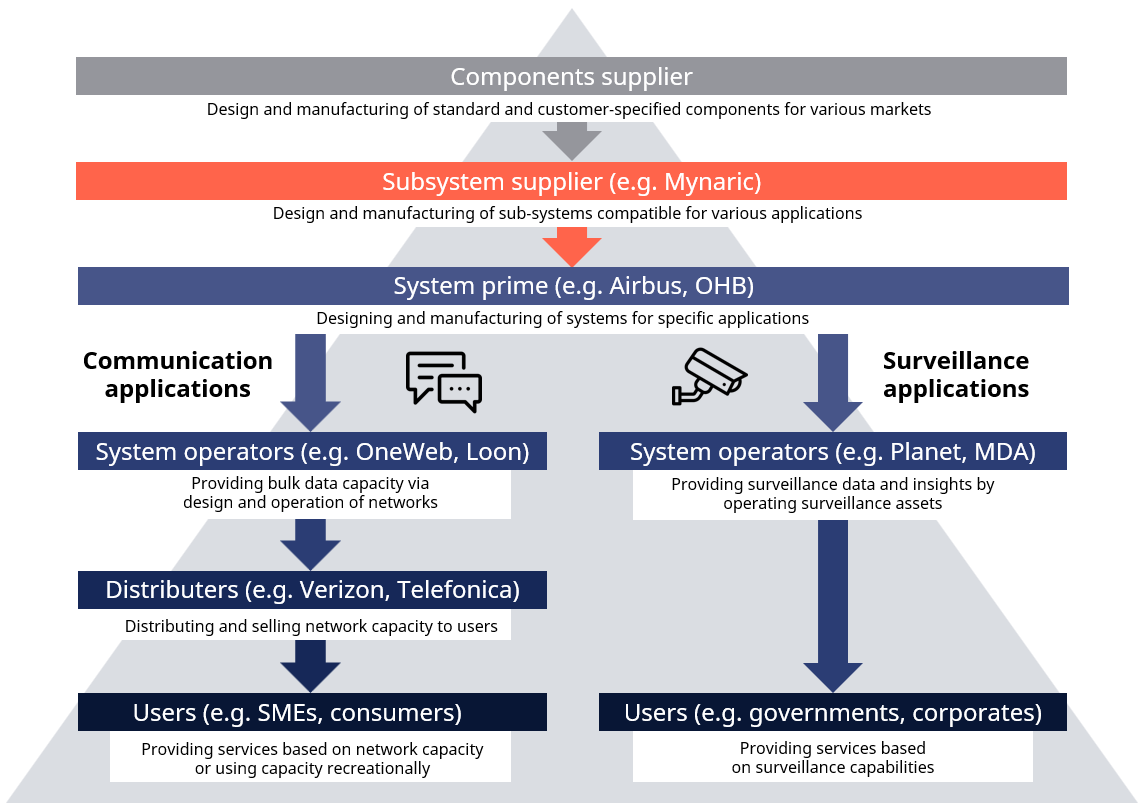

But to focus just on the large constellation builders is to overlook the obverse of the connectivity coin. The aerospace connectivity market is being driven by international heavyweights offering both communication applications and a burgeoning surveillance market.

In both sectors, it is large multinationals driving progress. They occupy the key plank in the value chain – selling to distributors in the communications field and the systems operators in the surveillance field.

Looking at the communications arena we can identify companies in space and air who are establishing either global or localised constellations which are using optical inter-satellite links as a complementary adjunct to existing RF.

In low Earth orbit, SpaceX, LeoSat and Telesat are all trialling laser communication to connect their satellites and in the stratosphere both Google and Facebook’s high-altitude platforms have also linked from their HAPS to the ground using free space optical air-to-ground links.

With regard surveillance applications, whereas there is no explicit – or public – news on the use of laser communication from space to the ground (with companies such as MDA, Planet, EarthNow) the sheer amount of data being collected by Earth Observation satellites means that up to 30% of data collected is currently lost given the limitation that RF has in sending that data back down to Earth. Laser communication backbone networks can remedy this data bottleneck.

With regard surveillance applications, whereas there is no explicit – or public – news on the use of laser communication from space to the ground (with companies such as MDA, Planet, EarthNow) the sheer amount of data being collected by Earth Observation satellites means that up to 30% of data collected is currently lost given the limitation that RF has in sending that data back down to Earth. Laser communication backbone networks can remedy this data bottleneck.

The figures

This backbone connectivity equipment market supports industries operating in a wider $1.9 trillion market. Projections show that in two areas alone – the high-altitude telecommunication networks market being planned by the likes of Facebook and Google; and the inflight broadband market being worked on by Gee, Sitaonair, gogo, Thales – expected markets of over $100B and $130B, respectively, await.

This is before we even begin to look at the satellite ground segment that companies such as Kongsberg, BridgeSat, SpeedCast, iABG, RBC, and Atlas are working on and the numerous LEO satellite communication constellations in development.

The Value Chain

The diagram above sets out simply how the aerospace connectivity market is developing but let’s dig a little deeper to see exactly where the value proposition lies within all this.

If we take Telesat as our example, then we can assess a company that is planning an initial 100 satellite (eventually growing to 292) LEO broadband satellite constellation. Telesat has already announced that it will work with either Airbus Defence and Space or a consortium from Thales/Maxar to produce what is believed to be an estimated $3 billion worth of small telecom satellites.

Once established, Telesat will sell this capacity onto its more-than 400 customers.

One of those customers could well be a commercial telecommunications company, such as a Verizon, for example. Verizon commands 35% market share in the United States, boasting 145 million customers with annual revenue of $125 billion.

Underpinning this value chain – and providing the key backbone connectivity – are laser communication terminals allowing for the high bandwidth required and at a cost per bit that makes sense for the constellation builder. And in April, Northern Sky Research, the global satellite and space market research organisation, predicted that the market for inter-satellite laser communication terminals would generate $3.7 billion in revenue in the next 10 years.

The future

One useful way to look at the market is to split applications between communications and surveillance which serve distinct tasks and will shape the direction and growth of the aerospace communication market in their own ways for years to come.

And thankfully Mynaric sits right at the forefront of it ready to supply both sides of the market with the technology and capability to future proof and maximise returns for companies operating in both distinct markets.